Joseph Herrin (10-07-08)

Iceland is one of Europe’s smallest nations, having a population of 320,000 people. At the same time, it is a thoroughly modern nation, and the per capita income of its citizens is a robust $42,508, ranking fifth highest among all nations. As of 2007, Iceland is ranked as the most developed nation in the world, and the fourth highest in domestic output.

Iceland has some of the world’s highest levels of economic and civil freedoms. Its political system is very similar to that of the United States and England, being democratic and having both left and right wing parties.

[Information Source: www.wikipedia.com]

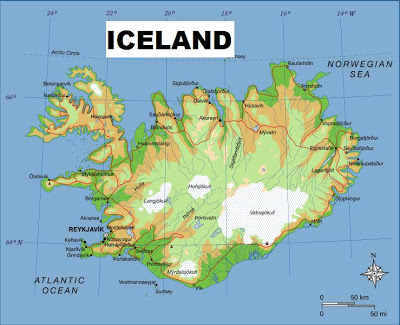

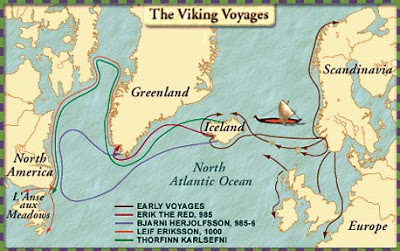

Iceland is uniquely situated between mainland Europe and North America.

It would seem to be a fitting place for the New World Order to use as a test case for their plans for North America and Europe. The economic collapse that has been threatening in America and Europe has come to a great climax in Iceland over the week-end, and during the past couple days. Although news on what is transpiring in Iceland is difficult to find in America, it can be searched out with a little diligent probing.

Before I cite some details of what is taking place in Iceland at this time, let me share that it is often the method of the banking elite to run a test case before they execute their larger plans. A case in point is the Spanish Civil War of 1936 to 1939. The international bankers financed both sides of this conflict, as they have done in numerous wars, and it proved to be a training ground for Germany and Italy who entered the war on one side with Portugal, and for Russia who entered the war on the other side along with Mexico.

Historians have cited the beneficial nature of this war in Spain as a training ground for the German armed forces who were soon to be unleashed upon much of the world. It also gave the bankers the opportunity to lend covert support to both sides of this campaign, a practice which continued throughout the ensuing World War.

I believe it is possible to look at what is happening in Iceland and to foretell to some degree what is coming to America. Following are some extracts from recent news articles.

Emergency Law Takes Effect in Iceland

Iceland’s Althingi parliament accepted a bill last night on an emergency law enabling the government to stage an extensive intervention in Iceland’s financial system—The most radical economic measures that have ever been taken in the country’s history.

Iceland’s Prime Minister Geir H. Haarde addressed the parliament yesterday evening with the bill, explaining that the emergency law is necessary to prevent the nation from falling into crippling debt or even national insolvency in the coming decades, mbl.is reports.

“The danger is real, dear countrymen, that the Icelandic national economy—if the situation develops in the worst possible way—would get sucked with the banks into the furious surf and the consequence would be nation-wide bankruptcy,” Haarde said in his address to the nation earlier in the day.

“No responsible government would jeopardize its nation’s future in such a way, even when the country’s bank system is at risk. As heads of state, we do not have the authority to take such measures,” Haarde continued in explanation as to why the emergency law is necessary.

According to the new law, under exceptional circumstances (i.e., exceptional financial and/or economic difficulties) the minister of finance would be empowered to act on behalf of the state to allocate capital to establish a new financial company or assume the operations, in whole or in part, of existing financial operations (including banks).

The state treasury may, under certain circumstances, provide saving banks with funding of up to 20 percent of their reported equity.

According to the law, the Financial Supervisory Authority (FME) may intervene in the operations of financial companies with extensive measures in order to minimize damage or the risk of damage to the financial markets. These measures include:

– Calling shareholder meetings or meetings for primary capital owners regardless of the company’s approval or stipulations in the Icelandic Companies Act.

– Assuming the power of shareholders or primary capital owners in order to make decisions on necessary actions. This includes limiting the board’s right of decision, suspending the board’s powers in part or in whole, assuming assets, rights and responsibilities in part or in whole of financial companies and dispose of such companies, including mergers with other companies.

– Limiting or prohibiting financial companies from disposing of its financial instruments and assets.

– Compelling financial companies to apply for moratoria or resort to debt pooling.

Deposits will be given priority in cases of bankruptcy, with balances being reimbursed in ISK. The state Housing Financing Fund would then be permitted to assume mortgage loans originally entered by financial companies.

Last night’s legislation comes in the wake of yesterday morning’s announcement by the Icelandic Financial Supervisory Authority that trading would be suspended in all Icelandic financial companies on that day (i.e., Glitnir Bank, Kaupthing Bank, Landsbanki Bank, Straumur-Burdarás Investment Bank, SPRON and Exista)…

The prime minister reiterated that all the public’s deposits in the banks are safe. They will be entirely insured. However, Haarde also commented that shareholders in these financial companies would sustain damage.

http://www.icelandreview.com/icelandreview/daily_news/?cat_id=16539&ew_0_a_id=313201

Following is a second article on this matter:

Terror as Iceland faces economic collapse

The Icelandic Government seized control of the country’s biggest banks last night in an attempt to fend off wholesale economic collapse.

Turmoil at the banks, whose shares were suspended by the Government yesterday afternoon, had sparked panic in the tiny state, which has a population of 300,000, about the size of Coventry.

Queues formed at petrol stations as Icelanders rushed to fill up before reported fuel shortages, while savers who tried to withdraw money from banks or sell bank shares on the internet found websites were not working…

Sources said that Landsbanki and the country’s third-biggest bank, Glitner, will soon be fully nationalised, while Kaupthing had been forced to take state loans.

In a late-night sitting, parliament approved a Bill giving the Government wide-ranging powers over the banks, including the ability to seize their assets, force them to merge or compel them to sell off their overseas subsidiaries, many of which are in London…

In Reykjavik, the capital, confusion reigned among a public unsure whether their savings and investments were safe, even after the Government moved to guarantee deposits. The country’s state surgeon even warned politicians and the media to ensure that they did not alarm old people…

[Source: http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article4894904.ece]

Following are excerpts from a third article:

Icelandic Prime Minister Geir Haarde warns nation of bankruptcy

Icelandic Prime Minister Geir Haarde addressed the nation as the country faced its worst economic crisis in modern times and introduced emergency legislation.

Following are excerpts from a text of the speech released by the Icelandic government.

Fellow Icelanders…

The entire world is experiencing a major economic crisis, which can be likened in its effects on the world’s banking systems, to an economic natural disaster…

The Icelandic banks have not escaped this banking crisis any more than other international banks and their position is now very serious. In recent years the growth and profitability of the Icelandic banks has been like something akin to a fairytale…

When the international economic crisis began just over a year ago with the collapse of the real estate market in the U.S. and chain reactions due to the so-called sub-prime loans, the position of Icelandic banks was considered to be strong, as they had not taken any significant part in such business. But the effects of this chain of events, have turned out to be more serious and wide ranging than anyone had expected.

In recent weeks the world’s financial system has been subject to devastating shocks… The effects have been that large international banks have stopped financing other banks and complete lack of confidence has developed in business between banks. This has caused the position of Icelandic banks to deteriorate very rapidly in the last few days…

There is a very real danger, fellow citizens, that the Icelandic economy, in the worst case, could be sucked with the banks into the whirlpool and the result could be national bankruptcy….

The position has today altered completely and for the worse. Major credit lines to the banks have been closed and it was decided this morning to suspend trading with the banks and with the savings funds in the Icelandic Stock Exchange.

We now need responsible and measured reactions…

By making these changes in legislation we will adapt the banking system to Icelandic circumstances and rebuild the trust of foreign operators in Icelandic banking and financial operations. If the bill is passed today it can be assumed that the measures will come immediately into force.

I would like to diffuse all doubt that deposits by Icelanders and private pensions savings in all Icelandic banks are secure and the exchequer will ensure that such deposits are reimbursed to savers in full….The authorities will also ensure that the country’s businesses have access to capital and banking services to the maximum extent possible…

If there was ever a time when the Icelandic nation needed to stand together and show fortitude in the face of adversity, then this is the moment. I urge you all to guard that which is most important in the life of everyone of us, protect those values which will survive the storm now beginning….

Despite this major setback the future of the nation is both sure and bright. What is most important is that the foundations of our society and the economy are solid, even though the superstructure has given way in the face of the present disaster.

By the same token, we will have the opportunity to rebuild the financial system. We have learnt from those mistakes which were made during that period of massive growth and that experience will prove to be valuable when put to the test. With a common effort and with that optimism which characterises the Icelandic people, we will emerge from these difficulties and make a new and energetic come-back…

The task of the authorities over the coming days is clear: to make sure that chaos does not ensue if the Icelandic banks become to some extent non-operational. For this the authorities have many options and they will be used. Both in politics and elsewhere it will be important to sheathe our swords. It is very important that we display both calm and consideration during the difficult days ahead…

[Source: http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article4894846.ece]

I believe we will be hearing similar declarations in America in the very near future. Much can be gleaned from what is happening in Iceland. I highlighted some key sections in bold print. It was reported that the crisis was precipitated by large international banks cutting off lines of credit to Iceland’s banks. Who do you suppose controls these large international banks that have caused this event to happen? It is the same international bankers and industrialists that own the Federal Reserve Banks in the United States. It would be a simple matter for them to precipitate and identical crisis in America.

Notice what the Prime Minister of Iceland described as a “measured response” to the crisis. Financial corporations can be taken over. Banks can be nationalized. The Treasury can call shareholder meetings without the consent of the corporations. Decisions can be made on behalf of the corporations including forcing them to declare bankruptcy, forcing them to merge with other banks, forcing them to sell off their assets to the international bankers that created the crisis. And there is no recourse for the owners of capital, or the stockholders of the companies. They will suffer loss.

One thing that stood out in what is happening in Iceland was described in the following sentence:

The state Housing Financing Fund would then be permitted to assume mortgage loans originally entered by financial companies.

We have been seeing a quick grab of the American citizens’ mortgages by the government in recent weeks. When the government took control of Fannie Mae and Freddie Mac they acquired over five trillion dollars worth of mortgages in one act. Then there was the takeover of Bear Stearns, and the government took its assets which included billions of dollars worth of mortgages. Then the government okayed the action of the Federal Reserve and Treasury in trading cash to financial institutions in trade for their illiquid assets (meaning mortgages). Why is the government getting in the mortgage business? It is because whoever controls the basic necessities of life, especially food and housing, ultimately controls the people.

It is not merely a coincidence that the President issued a directive in 2004 which gave the Executive Branch and the Department of Homeland Security the authority in a time of crisis to seize control of the nation’s food supply and to appoint themselves as the distributor of all food. You can read about Homeland Security Presidential Directive 9 (HSPD9) online:

http://www.whitehouse.gov/news/releases/2004/02/20040203-2.html

Every day you are reading about the government offering some new program to bolster the economy, but the economy is not improving. What is really being done is that the government is becoming the owner of everything of value. Following is an excerpt from an article posted today on CNN Money.

The Federal Reserve said Tuesday it will buy commercial paper, short-term debt that companies use to finance daily operations, from individual companies. Panicky investors have been less willing to buy this kind of debt lately, making it hard for companies to get the money they need to operate.

The Fed move is aimed at creating a market for this kind of debt, ultimately loosening up the frozen credit markets.

Businesses depend on the credit markets to function on a daily basis, and the absence of ready capital has hurt consumers and the broader financial system.

“It’s another step in the right direction, but it’s hard to get too excited about this because nothing yet has worked,” said Bill Stone, chief investment strategist at PNC Financial Services Group.

“Eventually, if they [the government] stack up enough things, something will work,” he said.

The government has taken a number of dramatic steps of late to try to get the markets functioning properly again amid the housing collapse and subsequent credit crunch.

On Monday, the Fed made an additional $300 billion available to banks in return for a range of damaged assets, on top of another $300 billion already available. The Fed could expand that to $900 billion total by the end of the year.

[Source: http://money.cnn.com/2008/10/07/markets/markets_newyork/index.htm?cnn=yes]

The Federal Reserve is loaning the United States Government money to loan to businesses for short term debt. This means the government will be an owner of whatever company borrows money from them. It will then seem justifiable for them to step in as the government in Iceland has done, and take over entire companies, forcing them into bankruptcy, forcing some to merge, or sell their assets, and telling the stock holders of capital owners that they have simply lost their investment.

We also read in this same article that the Fed is buying hundreds of billions of “damaged assets” from banks. These damaged assets include more mortgages. Truly the day is coming when the government and the Federal reserve are the landlord for the entire country, and this day is coming quickly. When this day comes the people of God will have to decide whether they will look to the government for food and housing, or whether they will look to God to supply this need. The government will most likely make an attractive offer for people, promising to provide their basic needs, but it will come with a great price. Eventually it will require receiving a national identity card to transact all business, and then an implantable chip.

God would have His children understand the day they live in. The hour is truly late. The end of this age is at hand, and the Millennial Kingdom is approaching. The transition will be very climactic, and it will require courage, faith and obedience from the children of God. Yet all who place their trust in Him will find that He is faithful. He has been preparing a people for this day to serve as guides for those who must enter this wilderness experience ahead. Yet ultimately, the Spirit of Christ is the guide which every believer must pay close heed unto.

Are you hearing His voice this day? Have you been following the Spirit of Christ wherever He might lead you? Is there anything in your life, any un-confessed sin, any idols, that are keeping you from hearing His voice? Is there any obedience in which you have fallen short?

The time to remedy these things is now. Do not wait until your situation mandates that you hear His voice to get right with Him. Now is the time to have the channels of communication open between you and God. Press into Him and ask Him to make His will and thoughts known to you. Whatever He requires of you, do not hesitate to do it. Take to heart the parable of the five wise and five foolish virgins. Do not wait until it is midnight to acquire oil for your lamps. Do it while you have opportunity.

May you be blessed with peace and understanding in these days.

Heart4God Website: http://www.heart4god.ws

Parables Blog: http://www.parablesblog.blogspot.com

Mailing Address:

Joseph Herrin

P.O. Box 804

Montezuma, GA 31063

Joseph, I appreciate your insights! May God continue to bless you with understanding and the ability to communicate Truth to God’s people and to those who may be searching for Truth in these last days before Yeshua HaMashiach’s second coming…

blessings,

mid